• The report Insurtech Global Outlook 2021 by NTT DATA analyses the trends, challenges, and opportunities in the insurance industry, providing expertise on the insurtech companies with the greatest impact in the sector.

• Last year, insurance firms invested nearly 1.6 billion dollars in startups, a year-on-year increase of 61% from 2019 to 2020

• COVID-19 accelerates usage-based insurance, telemedicine, diagnosis tools or distribution digitalization

Cluj Napoca, May 27 2021 – NTT DATA presented the fifth edition of its report Insurtech Global Outlook 2021, a study that analyses the main trends in the insurtech ecosystem and the impact that advanced technologies and new business models had throughout 2020.

The report examines the market, bearing in mind the possible impact of the pandemic, drawing the conclusion that uncertainty and increased risks encourage and prompt investments in insurtech. It also points out that direct investments were made in insurtech during 2020, both in well-established and new and disruptive companies.

The study goes into greater detail on issues as varied as the investments received by insurtechs by region, lines of business and technology investments. It also analyses the companies in which the insurance firms decided to invest, how these investments are distributed over different areas of the insurance value chain, as well as the main movements with regard to insurer ecosystems. The analyses are conducted from different yet complementary viewpoints, such as those of the insurtechs and tech giants.

The report’s results reveal that 2020 was a year in which both insurers and insurtechs managed to mitigate the consequences of COVID-19 in an extremely agile and streamlined way. It claims that these companies took advantage of the situation as another accelerator in their digitalization processes.

Despite receiving record investment figures, the real impact on the market by Insurtech companies is still questioned for various reasons, such as market share, income results or market capture. Organizations with these working models still must settle in the markets, generating the promised disruption to those who bet on this model and that in a context like the current one should be established more deeply. There is a long way to go to reach an optimal level of disruption. A reflection of this is that companies with sustained growth do not enter the market with a large share in a relevant way.

The analysis containing all these variables creates a realistic snapshot of the sector, of investors’ preferences and of the technologies that define the trend that is reformulating the insurer universe in the new digital age.

Furthermore, the capability of real-time information automation with data analysis technology—which integrates a repository with detailed information about startups’ activity related to the insurer sector around the world—helps to constantly update and analyze core information and ensure a more realistic and precise outlook.

Insurtechs are now perceived as a valuable asset by insurance companies, which know that they can have a highly positive impact on their businesses. Learning about these companies in detail and what their contributions may be within the sector translates into knowing how to take advantage of new opportunities and face challenges moving forward with better guarantees of success.

Greater investment, innovation, personalization, and technology as trends’ basis

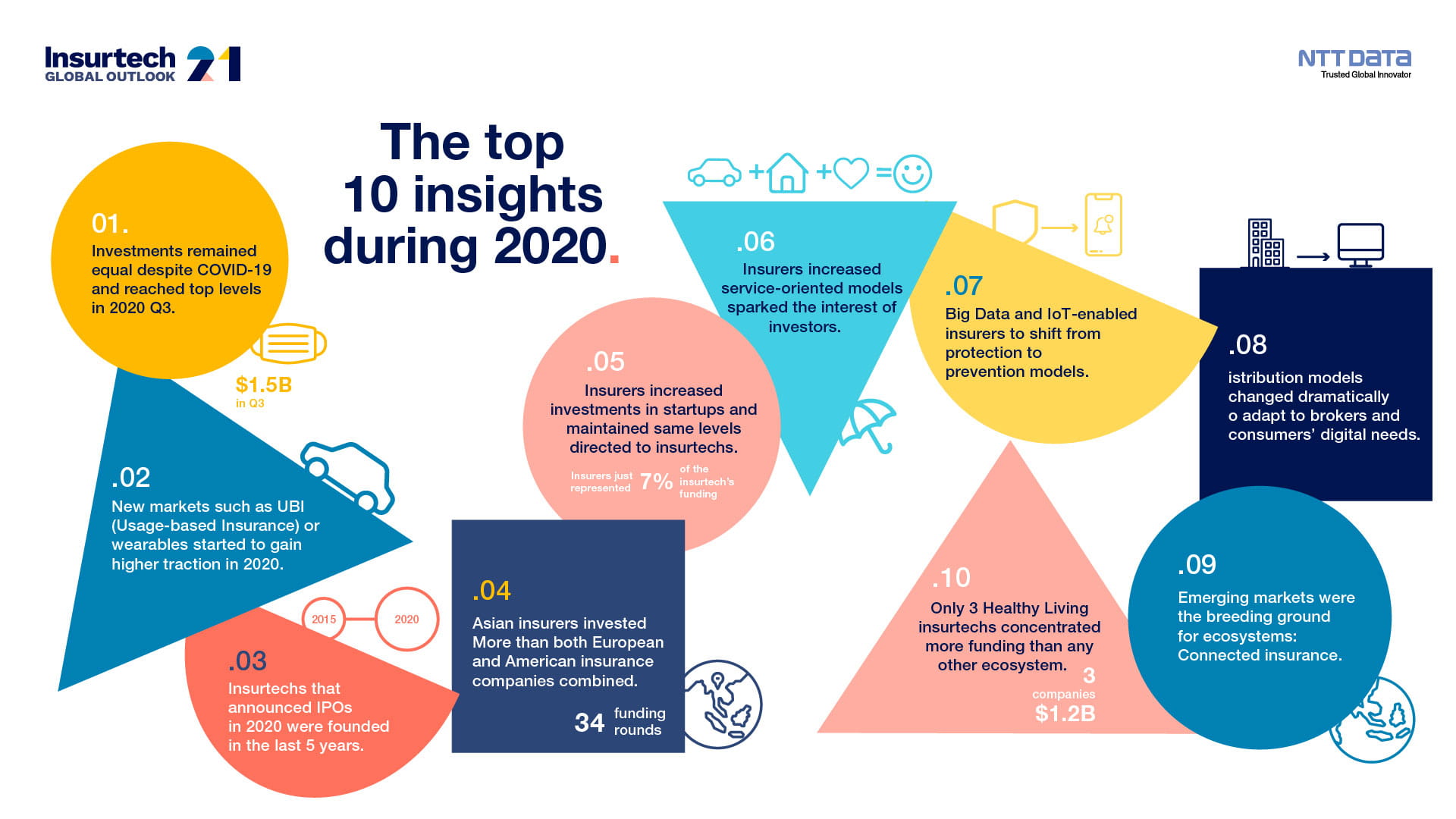

The Insurtechs are experiencing a record moment. Not only have they been able to overcome the uncertainty generated by COVID-19, but they have managed to attract more investment, reaching 7,000 million dollars if we consider the companies that went public during the year (Lemonade and Root, valued at 1,000 million dollars). This is reflected in the quarterly figures, although it is true that investment has remained at levels before COVID-19, reaching 6,000 million dollars -only 6.25% less than in 2019- where 6 operations represented an amount of and even record levels in Q3 2020 with $ 1.5 billion mostly from Super Deals in Europe and North America.

Although they are indeed in a "sweet" moment, in terms of investment, it is a key moment in which to settle in the market and demonstrate that the disruptive potential has a real impact on business. For now, not even the exposed cases that went public (Lemonade and Root) with sustained growth of 100% and recently going public, have managed to increase their market share by more than 0.1-0.2%.

Taking this scenario into account, the trends are clearly different in a year-on-year comparison, due to a more accelerated context and a stronger demand from the market to achieve objectives.

On the one hand, the pandemic has changed consumption models, and in the insurance sector, this has not been different. With a greater degree of personalization, it has been determined that the acceleration of new models is clear: pay-per-use models, telemedicine, diagnostic tools, or the digitalization of distribution are growing, such as UBI (Usage-based Insurance) Usage-based insurance, as well as wearables, have gained further momentum during the year. Added to this, the broker platforms and cyber insurance that received relevant investments and income announcements in 2020.

On the other hand, the pandemic crisis did not prevent insurers from continuing their digitization path, which confirms that the insurers' vision of how Insurtech drives digital transformation and innovation for the sector remains in force. Last year, insurers allocated almost 1,600 million dollars in startup models, increasing investments compared to 2019 by 61% throughout the year 2020, of which 445 million went to Insurtech.

Regarding the detail of these investments, insurers centralized most of their capitalizations in startups in the growth phase, with an average of 23 million per round in 2020. In addition, within these bets, insurance investors focused their selection on companies that work with technologies such as cloud, mobile, and applications, added to their preferences in business models focused on the personalization of insurance, aggregators, platforms, and comparators.

These new technology-supported companies - many of them based on the IoT - are promoting the transition of the insurance sector from protection to prevention.

Insurers and startups are using unique data sets and Artificial Intelligence to reduce and manage claims costs while helping clients prevent unwanted events. In addition, this year there is a special growth of the IoT impacting all business lines, auto with insurance based on use, health, and life through wearables, but also at home with leak detection devices, flooding, or commercially with parametric policies for transport and special risks. Wearables, diagnostic tools, and wellness apps are three of the main trends in 2020. Cross-cutting technologies support all business lines contributing to improving the customer experience and increasing their management efficiency.

Emerging markets and regional differences in investments

Some of the Asian players have been perfectly understanding the concept of ecosystems in the insurance sector for years. This is mainly because this region has access to the three variables necessary to boost ecosystems: large populations, technology adoption, and low insurance penetration. In these huge markets, there is a high level of digital adoption by users and, in general, a very low insurance penetration rate -1%, while a consolidated market in another area reaches almost 5% -, which makes these B2B2C business models work remarkably well for Insurtech or insurers. They offer insurance - microinsurance included - in the channels of other actors, which allows a new digital distribution to be carried out that reduces elements such as the cost of customer acquisition. In this way, these connected ecosystems also produce other types of improvements, such as generating a better customer experience, or direct access to end customer data.

Although the participation of Asian insurers in previous years was relevant, in 2020 they led the Super Deals or investment agreements with the greatest attraction effect and eclipsed European and American insurers. Thus, Asian insurance investors, four of them led the largest rounds in 2020, concentrating more than 1,100 million dollars of investment.

The two great investment behaviors on the part of insurers are also evident. On the one hand, the concentration of investment is in the most advanced round startups and more consolidated models (the so-called outliers) with operations of more than 100 million dollars, mainly located in the United States and Asia. But on the other hand, the study shows that the largest number of operations are in younger companies that are beginning to use their models (the so-called standards) and that complement the value offer, in addition to transforming part of their value chain. These companies are mainly European, and the operations are around 5 million dollars.